USMCA Compliance Services

Home / Expertise / Trade Compliance / USMCA Compliance Services

USMCA

COMPLIANCE SERVICES

With the U.S. – Mexico – Canada Agreement (USMCA) taking effect on July 01, 2020, the U.S. Customs and Border Protection (CBP) has implemented new guidelines and regulations for international trade with the USA. The USMCA replaces the North American Free Trade Agreement (NAFTA) and provides detailed information on business obligations, customs duties, compliance certifications, and shipments.

One key component of the USMCA is the USMCA Certificate of Origin, which is essential for shipping goods between Canada, Mexico, and the United States. This certificate can be completed by a producer, exporter, or importer and requires nine minimum data elements to be filled in as mandatory. Additionally, the certificate must be accompanied by a statement.

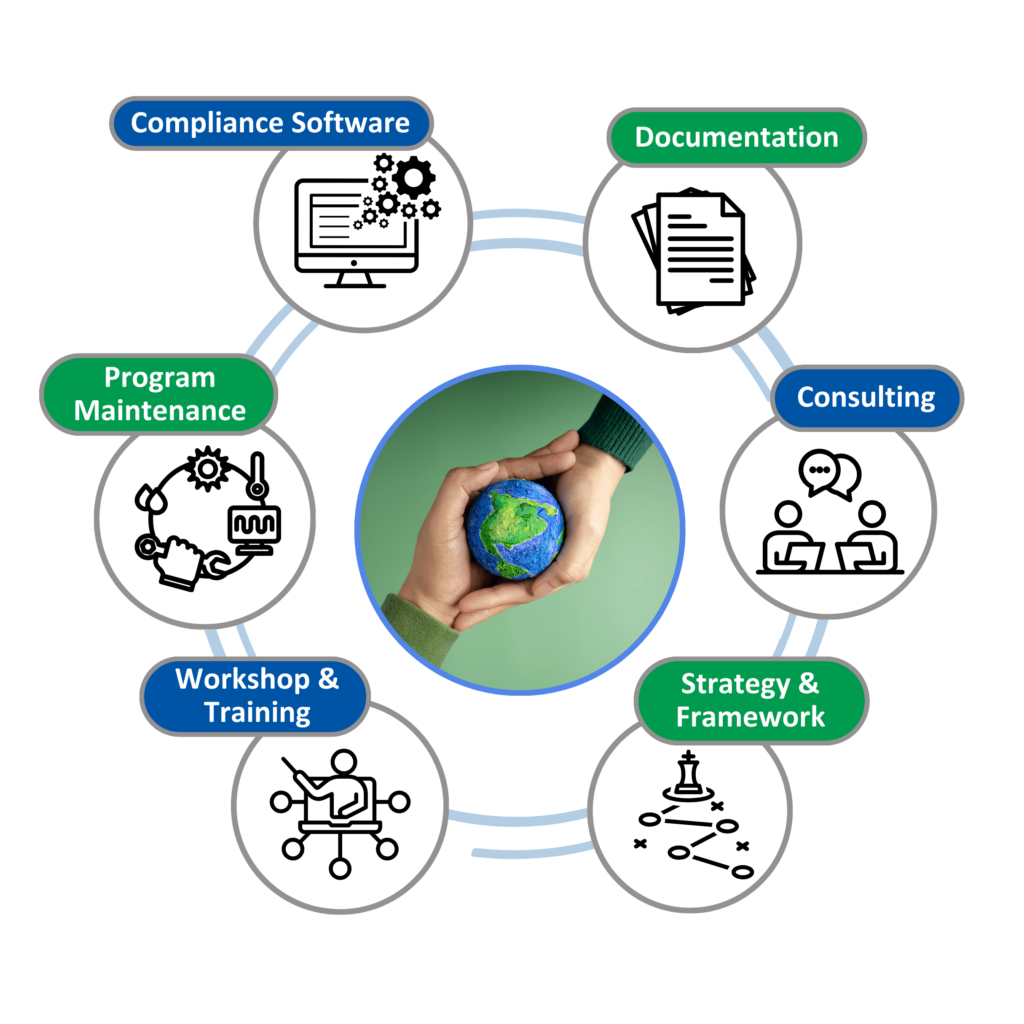

ComplianceXL offers consulting services on various USMCA reporting requirements and provides trade compliance training. With international trade compliance becoming increasingly complex, ComplianceXL aims to assist companies in complying with new regulations and managing trade practices effectively. By optimizing supply chain processes to align with regulatory needs, ComplianceXL helps minimize noncompliance risks.https://compliancexl-dev.10web.cloud/solutions/training-support/

We effectively address these trade compliance challenges

- Finding the right balance of resources and technology

- Formulate trade compliance strategy.

- Empower import and export processes by mitigating noncompliance risks and

reducing overheads. - optimizing cycle times to gain a competitive advantage in international trade.

Services Portfolio

- Training on USMCA requirements

- Define supplier documentation requirements.

- Rollout supplier surveys

- Manage supplier surveys and supplier engagement.

- Support suppliers across time-zones and multiple languages

- Validate information received from suppliers, such as

- Country of Origin (CoO) of parts/materials

- Blanket period

- Harmonized Tariff System (HTS) classification